For Anyone Looking To Secure a Comfortable Retirement

New Book Reveals: A Counterintuitive Approach That Maximizes Your Retirement Savings Without Risky Investments

While also minimizing tax burdens, ensuring flexible access to funds, and preserving wealth for your heirs.

Hit Play On The Video

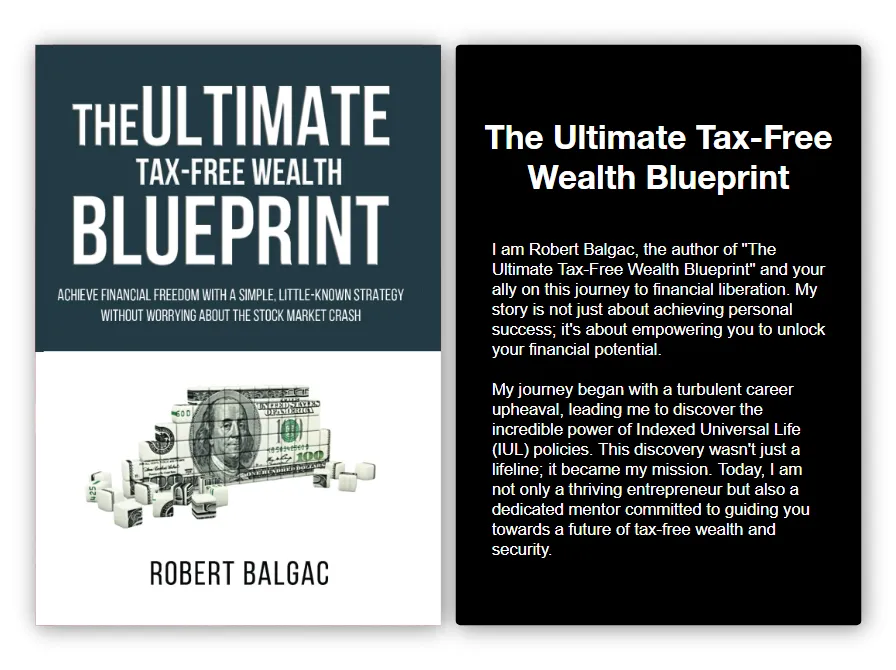

What is The Ultimate Tax-Free Wealth Blueprint?

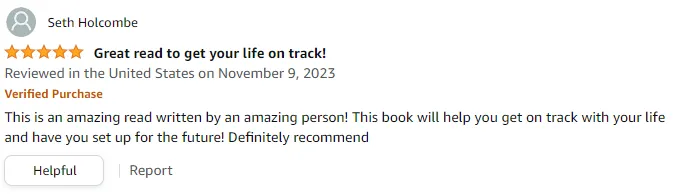

The Ultimate Tax-Free Blueprint is a counterintuitive approach to building your retirement nest egg, that allows you to enjoy growth potential and financial security without depending on the volatile stock market.

We achieve this by utilizing the robust structure of Indexed Universal Life (IUL) policies without exposing your retirement funds to market downturns or excessive taxation.

And as a result... this frees you up to focus on living your best life now and in the future - this is The Ultimate Tax-Free Blueprint.

Get Your Copy Now

100% secure 256-bit encrypted checkout

Backed by Our 100% Money Back Guarantee.

The Ultimate Tax-Free Wealth Blueprint is a shortcut

Before I created The Ultimate Tax-Free Wealth Blueprint - I was struggling with the unpredictability of the stock market for years and was on the verge of giving up.

I was struggling with the unpredictability of the stock market for years and was on the verge of giving up.

I was working tirelessly, investing in a volatile market, trying different financial advisors, and jumping through hoops trying to maximize my retirement savings.

I got myself a deal I never signed up for.

Which led me to questioning everything and eventually turning the entire model upside down, breaking all the rules and freeing me from the chains of the old ways.

After several years of trial-and-error, testing everything and figuring things out the hard way - without anyone guiding me I've finally reached a point where I have a stable, tax-free income for my retirement.

Now, you have the opportunity to duplicate the entire Ultimate Tax-Free Wealth Blueprint system I built by downloading a $7 Book called The Ultimate Tax-Free Wealth Blueprint

Here's how it works

Over 700+ 5-Star Reviews ⭐

We Work With Companies You Can Trust

Here's How I Went From Being at the Mercy of the Market's Ups and Downs To

Enjoying a Secure and Prosperous Retirement By Ignoring The Common Wisdom, Breaking All The Rules, And Turning The Retirement Planning Model Model Upside Down

This Is Something Completely New, Completely Different, Completely Unlike Anything You've

Ever Heard of Before - Read The Story Below To Discover The Ultimate Tax-Free Wealth Blueprint

Dear Future Ultimate Tax-Free Wealth Blueprint Owner

From: The laptop of Robert Balgac

Re: Securing a Tax-Free Retirement (and why this is your only way out)

Would it surprise you to learn, that I achieved a completely tax-free retirement using the information revealed in this 129-page book?'

Skeptical?

You should be.

After all, you can’t believe everything you read on the internet :-)

so let me prove it to you

But first, read this disclaimer:

I have the benefit of years of financial planning experience.

The average person who buys any “how to” information gets little to no results. I’m using these references for example purposes only.

Your results will vary and depend on many factors …including but not limited to your background, experience, and work ethic.

All purchases entails risk as well as massive and consistent effort and action.

If you're not willing to accept that, please DO NOT GET THIS BOOK.

And yes, it took me time and energy to achieve my results.

With that said … let me jump right in and show you...

And I Did It By Using A Completely Counterintuitive Model That I’m About To Share With You On This Very Page…

The same Ultimate Tax-Free Wealth Blueprint model that individuals from all over the world are now using to secure a tax-free retirement…

...And in turn safeguard their financial future faster than ever before...

...All while eliminating the anxiety of market volatility so they can focus on WHAT THEY WANT...

And best of all, leaving a lasting legacy for their families.

Just Like Shannon Hay, Who Followed The

Ultimate Tax-Free Wealth Blueprint A Few Months Ago And Soon After secured a future for his family in the face of uncertainty

And even though getting a significant increase in their tax-free retirement savings, that's not the best part...

The best part is the peace of mind and financial security.

That's right, not only did they ensure a comfortable retirement, but they also gained confidence in their financial future.

And Dr. Kevin Hay isn’t the only one either…

This Is Latasha McCray, Another Ultimate Tax-Free Wealth Blueprint Member, Who Implemented The Strategy Not Too Long Ago…

...And soon established a solid foundation for her financial independence...

Here’s another Ultimate Wealth Blueprint owner who started using these strategies…

Meet Devan Shockley Who Got effective coverage and financial relief during his medical crisis

Dr. Kevin Hay, Latasha McCray, and Devan Shockley are a group of over 1,000 new wave of Ultimate Tax-Free Wealth Blueprint Owners who are doing things differently…

And you can BET...

This Ultimate Wealth Blueprint model is unlike any method you heard of before…

…This is something completely different, because…

We don’t focus on on risky investments.

We don’t focus on the conventional one-size-fits-all approach.

We don’t focus on complicated financial jargon.

We don’t focus on typical market volatility concerns.

In fact: we rarely (if ever) rely solely on traditional retirement plans.

Instead We we embrace a holistic and personalized financial planning strategy...

Like I said…

This is something completely different and it has the power to change everything for you…

…and I know that’s true…

Because it changed everything for me.

The Ultimate Wealth Blueprint model allowed me to get rid of 99% of all the BS that I hated when it comes to retirement planning…

I stopped relying on unpredictable market trends.

I ceased worrying about tax burdens on my retirement income.

I abandoned the one-dimensional financial planning models.

I let go of the anxiety over market downturns affecting my retirement.

I freed myself from the limitations of traditional retirement saving methods.

The Ultimate Tax-Free Wealth Blueprint Freed Me From All That and It Allowed Me To secure a stable, tax-efficient retirement.

Here’s what my life used to look like (and If you’ve ever planned for retirement, then I’m sure you can relate)…

I call this the “Retirement Planning Cycle Of Doom”:

Step 1 - Constantly worry about market fluctuations.

Step 2 - Stress over tax implications on my savings.

Step 3 - Struggle with understanding complex financial products.

Step 4 - Feel restricted by limited retirement saving options.

Step 5 - Be uncertain about my financial future post-retirement.

Step 6 - Experience anxiety during economic downturns.

Step 7 - Restart the cycle with each new financial trend or policy.

Step 8 - Start over

The Retirement Planning Cycle Of Doom Of Doom not only sucked, but kept me stuck for 3 years - forcing me to face constant uncertainty and lack of control over my financial future.

To be honest…

...I almost gave up on this whole idea of securing a stable, prosperous retirement with peace of mind.

... But before I gave up..

I wanted to try something.

Something that - if it worked.

It would change everything.

And as you're about to find out, what I tried...

... It worked...

And I spent years turning it into a system...

And I Put This Entire System In A 129 Page book Called “The Ultimate Tax-Free Blueprint” And You Can Start Reading It In Just A Few Moments From Now…

But before you do.

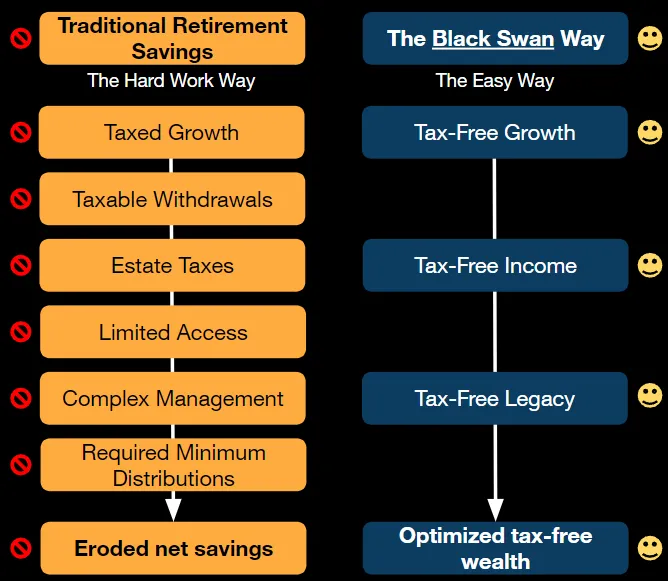

I’d like to introduce myself and tell you about how all this came to be.

My name’s Robert Balgac…

You probably haven’t heard that name before. That’s by design.

I'm living a dream I never thought possible – leading a successful life insurance agency, helping thousands of families secure their future, and enjoying the freedom of being my own boss. Not to mention, the pride of turning a tough situation into a thriving entrepreneurial journey.

Here are some snapshots of the dream life – achievements, happy clients, and the joys of entrepreneurship...

As of writing this, I’m currently living in a picturesque suburb, enjoying the balance between a buzzing professional life and serene family time.

As We Get To Know Each Other… You’ll Quickly Realize That I’m The Luckiest Person On Earth - So Let’s Talk About Where I Was On August 2017

I was in my late thirties and living in a newly bought dream home.

I had no job security.

I had no backup plan.

I had no control over my professional destiny.

... and being abruptly fired from my executive job meant I couldn’t provide for my family as I had always dreamed.

There’s a stupid myth out there...that climbing the corporate ladder is the only way to success and financial security.

… Well, sometimes it doesn’t.

And if you want true financial freedom, it is almost never the answer...

I know, because I tried.

I gave it everything I had.

I gave it my BEST shot.

And it didn’t work.

Because I played by the rules and I did everything right...

I Ended Up With a shattered career and a jeopardized family’s future. And I Hated It…

I hated it because it showed how vulnerable and unprepared I was for life's unpredictable turns.

I had goals, dreams, and aspirations...I wanted more out of life...

...and being jobless and directionless wasn't going to work.

So I did what everyone else out there does in this situation.

I started looking for a way out.

I looked everywhere and a few months later I found it.

I stumbled upon a forum where a group of guys and gals were talking about how they were "Financial Mavericks" living life on their terms and enjoying financial freedom.

This was a cool concept to me, and as I researched more and more, I found that most of them were just like me.

They also faced career setbacks and uncertainties.

The only difference was they discovered the power of Indexed Universal Life (IUL) policies.

Indexed Universal Life (IUL) Is One Of The Most Legitimate And Easy-To-Use If You Want To Secure A Tax-Free Wealthy Future

Just think about it:

Why settle for uncertain financial plans? IUL offers a more secure alternative.

Why rely on traditional retirement plans prone to market risks? IUL provides market-linked growth without the downside.

Why let taxes diminish your savings? With IUL, grow your wealth tax-free.

Why not leverage life insurance for more than just protection? IUL combines security with investment.

Why not take control of your financial future now? IUL gives you the flexibility and power to do so.

Indexed Universal Life (IUL) was the perfect thing for me...

And the best part that attracted me to doing it this way?

You Don’t Even Have To rely solely on traditional retirement plans.

Which means you can secure your family's future and build a tax-free retirement fund...

All you have to do is understand and leverage the IUL policy effectively.

And That Was The Birth Of My Journey Towards Financial Freedom.

After doing a bit of research - I started diving deep into the world of life insurance and IUL policies.

I had no idea how to navigate the complex world of insurance and investment.

All I knew how to do was learn, adapt, and apply.

Here's what my Before scenario looked like: A high-level executive uncertain about the future.

And even though I had the determination and the right information,

I still had to put in the hard work, learn the ropes, and face the challenges head-on.

Looking back, those first 3 Years were brutal.

Late nights.

Hard work.

Stress.

Facing skepticism and overcoming numerous obstacles.

That was my life and I was ready to quit.

But thankfully, I didn't...

That was 6 Years ago, And fast forward to today and it almost seems like a bad dream

I proved the idea of “following the traditional life path” to be all wrong…

Instead of being at the mercy of corporate whims,

I'm enjoying a successful career as an independent life insurance agency owner, securing financial futures and living on my terms.

Chatting with friends and writing this letter you’re reading.

I have my own thriving business, financial security, and the satisfaction of helping others achieve their dreams.

Unlike those stuck in the endless rat race, who are always chasing after elusive job security and financial stability.

You see, those individuals will end up spending all their time on trying to climb a corporate ladder that may not even exist in the future.

I did this for years, and it not only drove me crazy…

It drove me to the point where I was questioning my own worth and potential.

Instead of me securing a comfortable future, I found myself at a dead end.

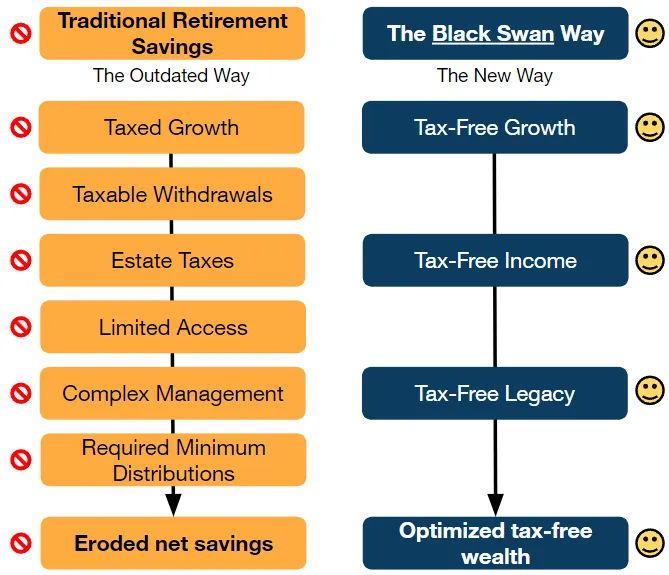

Wanna Know What The Main Difference Is With The Ultimate Tax-Free Wealth Blueprint Model And That “Old Way” Of Doing Things?

While they chase uncertain and risky financial plans, I create secure and tax-free wealth through IUL.

Rather than doing all those things I mentioned above in order to secure financial stability, here’s what it looks like now...

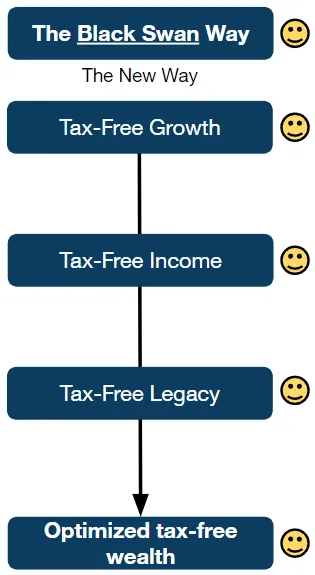

And The Result Of Using This New Way?

Which Naturally Leads To...

I get to enjoy peace of mind, financial independence, and the joy of helping others secure their future.

And the best part is that I achieved this without sacrificing my personal values or family time.

The really cool thing is that…

If you follow every single step that I teach, you end up with secured financial freedom and a prosperous retirement...

But it’s much more than that..

It’s Actually Transforming Your Entire Approach To Financial Planning...

How many retirement models have you seen come and go through the years?

People relying solely on 401(k)s...

Or depending on unpredictable stock market investments...

Or getting caught in the web of complex financial plans...

My approach has been going strong for 6 years straight now.

Now, speaking of the model...

I’m going to share something that’s a little bit disturbing with you.

Here it goes:

I am actually challenging the traditional financial planning norms by showing you this.

And the other gurus out there are making loads of money by teaching the opposite of what I teach (except it doesn't work).

Ready for it?

The #1 Mistake Everyone Else Makes is Not leveraging the power of Indexed Universal Life policies for secure, tax-free wealth.

Here’s why:

There are two types of financial planners out there.

There are the "Traditionalists" and there are "Innovators".

For my first few years in the industry - I was a Traditionalist

Traditionalists are always out there trying to fit into the conventional financial planning mold.

Their strategy is to try to conform to the standard financial advice.

And by focusing on this strategy - they spend a ton of time on..

Chasing after volatile investments.

Worrying about market downturns.

Struggling with complex tax implications.

Feeling insecure about their financial future.

All of this requires time and energy.

The problem isn't the model itself, it's that traditional financial planning often overlooks the unique advantages of IULs.

And this is the same exact thing that happened to me before I figured out The Ultimate Tax-Free Wealth Blueprint model.

The solution?

Embrace the power of Indexed Universal Life policies.

That's right...

I said it, we focus on secure, tax-free wealth building...

...Because I rather get steady, reliable growth instead of uncertain market returns.

No thanks. I did that before and it sucks.

So here's the deal...

...I explain everything in The Ultimate Tax-Free Wealth Blueprint, it's a 129 page book that shows you everything you need to know.

So here's the $700,000 idea behind The Ultimate Tax-Free Wealth Blueprint Model

There's a lot of activity happening in the world of financial planning.

With the advent of digital technology and the internet, the accessibility and complexity of financial information have dramatically increased.

This has created a thirst for innovative and secure financial strategies among those planning for their future.

Now, most of these individuals seeking stable retirement plans are looking for a new solution...

And as you may have guessed it - we have it.

And what's really cool is that our solution, focusing on Indexed Universal Life (IUL) policies, not only simplifies the retirement planning process but also offers a level of security and growth potential that traditional methods can't match.

That's Right - Given A Choice, They Rather secure tax-free wealth through IUL policies Than rely on traditional retirement plans that are often subject to market volatility and provide limited growth opportunities.

And that's where The Ultimate Tax-Free Wealth Blueprint comes in...

It does this beautifully in 4 easy steps...

And that’s the difference here.

When you approach your financial planning using this model, the results are amplified and sustainable.

In contrast, traditional methods often lead to uncertainty and dependency on market fluctuations.

I’m not saying traditional investing is bad.

What I’m saying if your goal is long-term financial security and tax-free wealth, traditional methods might actually be the thing that’s holding you back from getting it!

Traditional investing requires constant market monitoring, dealing with tax complications, and enduring the stress of market downturns.

The Ultimate Tax-Free Wealth Blueprint just requires a shift in mindset and embracing the power of IUL policies.

And that's why this is different.

And you know what? I'll Stake My Entire Reputation On This One Promise

You can achieve a stable, tax-free income for your retirement.

And once you start using this Ultimate Tax-Free Wealth Blueprint model...

Getting a secure financial future isn’t something you ever need to worry about again - or even think about.

It’s something that becomes a seamless part of your financial strategy.

Here’s what I want you to do now: set your calendar right now - set it to 6 months from today.

Because If you implement everything I’m going to share with you in The Ultimate Tax-Free Wealth Blueprint book,

That’s when you’ll start seeing your first glimpses of a secure financial future.

That’s how easy this is.

I know how ridiculous that sounds…and cliche that sounds…

And Just A Few Years Ago… i’d Tell You That You’re Crazy If You’d Ever Believe Such Model Existed…

…But, today I know better.

Listen:

I don’t care how many times you’ve tried to secure your retirement...

I promise you this…

Anyone can achieve financial freedom with the right model (more on this below).

Ultimately I want you to know one thing..

If I Can Do This, So Can You!

Because over 500+ others are doing it too right now using the Ultimate Tax Free Wealth Blueprint...

Here are some recent posts:

and here's another reason

you too can do this

It took me 6 years to "figure this out"...

...and another 2 years to perfect it.

Which is safe to say that there isn't anything left for you to figure out.

I already did all of the hard work for you.

I figured it all out.

Which means...there’s nothing for you to “figure out”.

You just need to download this book and most important of all - implement it!

That’s it…

Here’s The exact 4 Step System Revealed in The Ultimate Tax-Free Wealth Blueprint Book For

Achieving Financial Freedom

Step 1 - Understanding IUL Fundamentals - (Learn the basics of IUL and its unique advantages)

Step 2 - Assessing Your Financial Goals - (Align your financial objectives with IUL’s capabilities)

Step 3 - Implementing the IUL Strategy - (Strategically invest and manage your IUL policy)

Step 4 - Maximizing Tax Benefits - (Utilize IUL for optimal tax savings and growth)

Those are the 4 steps to secure a stable, tax-free retirement.

All of this is revealed in the 129 pages of The Ultimate Tax-Free Wealth Blueprint ebook in step-by-step detail.

Making it a counterintuitive approach to achieving financial freedom for the person that seeks stability and long-term growth.

And that's not all, because...

here's what else you're going to discover in The Ultimate Tax-Free Wealth Blueprint

How To Achieve Financial Freedom With Indexed Universal Life (IUL) Policies (So You Can Secure A Lifetime Of Tax-Free Income)

All Explained In Chapter 1

How Doing Common Retirement Planning Mistakes Prevents You From Achieving Financial Security And What To Do Instead (And What To Do Instead)

All Explained In Chapter 2

How Doing [INSERT THING THEY ALL MISTAKENLY DO] Prevents You From [INSERT THING THEY WANT TO ACHIEVE] (and What to do instead)

All Explained In Chapter 5

The Little Known Loophole/Trick To Maximize Tax Savings In Retirement And How To Use It For Your Own Benefit (And How To Use It For Your Own Benefit)

All Explained In Chapter 6

The Step-By-Step Process To Set Up An IUL Policy For Retirement Income Planning So You Can Shortcut Your Results (So You Can Shortcut Your Results)

All Explained In Chapter 9

We’ll also show you how to maximize your retirement income while enjoying tax advantages and financial security! If securing a comfortable, financially stable retirement is what you seek, this is the ultimate guide on how to achieve it.

And Before You Download The Ultimate Tax-Free Wealth Blueprint Book… I Want You To Know That There's No Catch!

I realize this is very inexpensive and that I’m practically giving it away…

And you’re probably wondering:

“If you’re doing so well with this, why would you give it away for next to nothing?”…

So there has to be a “catch”…

And I know there are some websites out there that offer you a great deal on something but then they stick you in some program that charges your card every month.

This isn't one of them.

There's NO hidden "continuity program" you have to try or anything even remotely like that.

I'm literally giving you this entire book, for $7, as a means of "putting my best foot forward" and demonstrating real value.

My hope is that you'll love it and this will be the start of a good business relationship for years to come.

But with all that said, there is ONE thing to keep in mind:

This Won’t Last Long

The truth is...

I was planning on selling this book for $47, but that meant I had to print copies of it, store them and ship them.

Which would eat up profits and also make it much more difficult to help more people.

Then I sold The Ultimate Tax-Free Wealth Blueprint book for $37 and over 100 people downloaded it at that price....

...Which was was great, but then I realised hey - this is an eBook it doesn't cost me anything to sell other than a few bucks to advertise it.

By lowering the price to $7 it allows me to impact more people and help them Achieve Secure Retirement and Financial Freedom.

I consider that at true win/win...

Also in most cases, I take a loss when selling the book at this price.

It costs me just over $50.00 in advertising expense to sell one book.

So why would I do that?

Simple. I'm making this offer with the idea that you'll be very impressed with what I'm giving you today, and you'll want to do more business with me in the future.

I'm betting that you'll enjoy the book so much, you'll call and ask to take additional classes or trainings from me.

Pretty straightforward.

Anyway - with all of that said, this is a limited offer.

The BEST Money-Back Guarantee

In The World

And since you’ve made it this far, I’ll assume that you’re ready to order, so with that in mind...

This Offer Expires Soon!

so Here’s How To Order Today...

Click the button below and fill out the order form, and you’ll be reading the 2 Hour Agency in the next 2 minutes.

(Save $31.40 today) Download The eBook For $37 Just $5.60! Delivered instantly. Start reading in the next 2 minutes.

Now Available.

Included In Your Order:

Backed by Our 100% Money Back Guarantee.

Delivered to: Your Email Address / Instant Download

Get The Ultimate Tax Free Wealth Blueprint For Only $7

(Save $30 today)

Download The eBook For $37 Just $7! Delivered instantly. Start reading in the next 2 minutes.

Available For Instant Download

I’ll talk to you in our private community that you’ll get instant access to as soon as you download your copy of The Ultimate Tax-Free Wealth Blueprint.

Until then, to your success,

Robert Balgac

P.S. Remember, The Ultimate Tax-Free Wealth Blueprint comes with The BEST Money-Back Guarantee In The World.

Download it, read it, implement it, get results.

And if you’re not happy for any reason (and I mean ANY reason) - just let me know and we’ll refund you your $7.

Here's What's Included In The Book

How To Achieve Financial Freedom with Indexed Universal Life (IUL) Policies So You Can Secure a Lifetime of Tax-Free Income

All Explained In Chapter 1

How Doing Common Retirement Planning Mistakes Prevents You From Achieving Financial Security And What To Do Instead (and What to do instead)

All Explained In Chapter 2

The Secret Behind Building a Resilient Retirement Plan (So You Can Withstand Market Volatility and Economic Uncertainty)

All Explained In Chapter 5

The Little Known Loophole/Trick To Maximize Tax Savings in Retirement And How To Use It For Your Own Benefit (and how to use it for your own benefit)

All Explained In Chapter 6

The Step-By-Step Process To Set Up an IUL Policy for Retirement Income Planning So You Can Shortcut Your Results (so you can shortcut your results)

All Explained In Chapter 9

For Just $3.95

(Save $27.03 today)

Download The eBook For $19.97 Just $3.95! Delivered instantly. Start reading in the next 2 minutes.

Available For Instant Download

Here's What Others Have To Say

Matt K.

"Robert Balgac's book offers a transformative perspective on securing financial freedom. Drawing from compelling stories like Allen Iverson's shrewd contract with Reebok and George Washington's foundational leadership for the US, the narrative seamlessly combines historical and contemporary insights."

Frequently Asked Questions

Download The Ultimate Wealth Blueprint

(Save $27.03 today)

Download The eBook For $37 Just $9.97! Delivered instantly. Start reading in the next 2 minutes.

Available For Instant Download

Book Reviews

Video Testimonials

4 Steps To Achieving Financial Freedom

Get The Ultimate Tax-Free Blueprint

$5.60

(Save $31.40 today)

Download The eBook For $37 Just $5.60! Delivered instantly. Start reading in the next 2 minutes.

Available.

You're also getting..

Exclusive Video Training $700,000 Website Template Quickstart PDF Guide 2 Hour Agency Community 7 Day Fast Start Video Series

Backed by Our 100% Money Back Guarantee.

In this world, nothing can be said to be certain, except death and taxes

- Benjamin Franklin

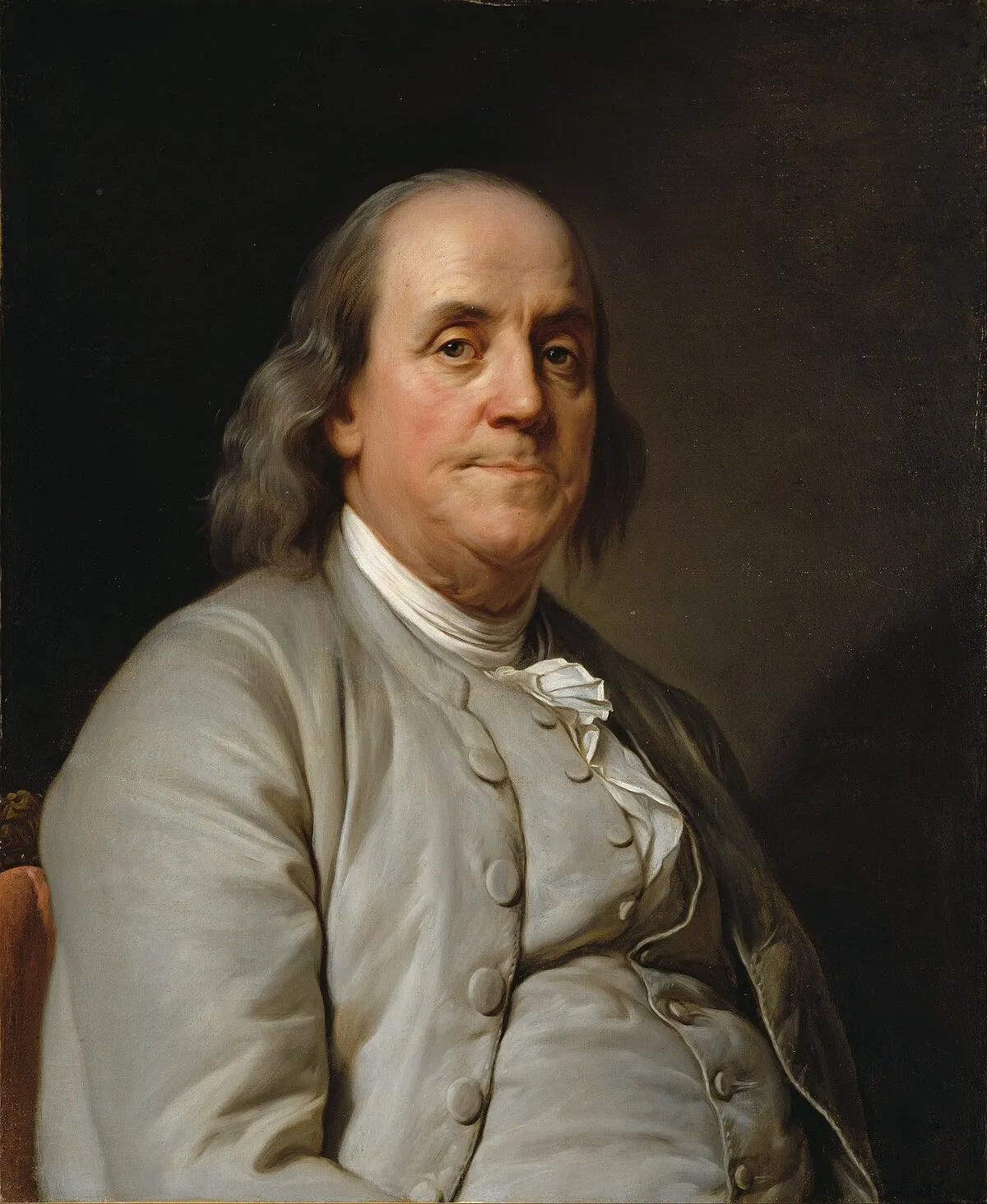

Here's a sneak peek Of What's inside the book

The best way to predict the future is to create it.

- Peter Drucker

BONUS CHAPTERS ADDED UPON REQUEST

Building A financial Fortress

In The Ultimate Tax-Free Wealth Blueprint you're not just going to learn how to strategically set up an Indexed Universal Life (IUL) policy for retirement income, I will also share some successful strategies I've used to:

Identify and define clear retirement goals, including desired age, income expectations, and lifestyle requirements.

Conduct a comprehensive assessment of their financial standing and risk tolerance.

Work closely with a qualified financial professional specialized in IUL policies for personalized planning and policy customization.

Implement a systematic approach to establish a customized IUL policy, ensuring it aligns with individual financial objectives and long-term goals.

Frequently Asked Questions

What is 'The Ultimate Tax-Free Wealth Blueprint' about?

The book provides a comprehensive guide to using Indexed Universal Life (IUL) insurance policies as a tool for retirement planning, offering a blend of life insurance protection and potential for cash value growth tied to stock market performance.

How does this book differ from traditional financial planning guides?

It introduces a counterintuitive approach that focuses on maximizing retirement savings through IUL policies, providing tax-free income and estate planning benefits, which are not typically emphasized in conventional financial planning.

Who would benefit from reading this book?

Anyone looking to secure a financially stable retirement, particularly those seeking alternatives to traditional retirement plans like 401(k)s or IRAs. It's also valuable for those interested in tax-efficient estate planning.

What are some key advantages of IUL policies as discussed in the book?

IUL policies offer tax-free growth, flexible access to funds without penalties, and a tax-free death benefit, making them a powerful tool for retirement income planning and wealth transfer.

Can 'The Ultimate Tax-Free Wealth Blueprint' help in tax minimization?

Yes, the book details how IUL policies can help minimize taxes, offering tax-deferred growth and the possibility of tax-free income during retirement.

Is this book suitable for those new to financial planning?

Absolutely. It breaks down complex concepts into understandable terms, making it accessible for beginners while providing depth for more experienced readers.

Does the book provide real-life examples or case studies?

Yes, it includes hypothetical case studies demonstrating how IUL policies can be effectively used in different scenarios, from young professionals to small business owners.

What makes IUL a 'counterintuitive' approach?

Unlike traditional investment methods that focus on stock market investments, IUL leverages life insurance policies for financial growth, offering protection against market downturns and tax benefits.

How can I implement the strategies discussed in the book?

The book suggests working with financial professionals specializing in IUL policies to find the optimal funding level for your needs and goals.

What is the main takeaway from 'The Ultimate Tax-Free Wealth Blueprint'?

The key lesson is that understanding and utilizing IUL policies can lead to a more secure financial future, with better control over your retirement income, tax benefits, and the ability to leave a lasting legacy.

This site is not a part of the Facebook website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc.

This product is brought to you and copyrighted by Black Swan Marketing Group

We can not and do not make any guarantees about your ability to get results or earn any money with our ideas, information, tools, or strategies. What we can guarantee is your satisfaction with our training. We give you a 30-day 100% satisfaction guarantee on the products we sell, so if you are not happy for any reason with the quality of our training, just ask for your money back. You should know that all products and services by our company are for educational and informational purposes only. Nothing on this page, any of our websites, or any of our content or curriculum is a promise or guarantee of results or future earnings, and we do not offer any legal, medical, tax or other professional advice. Any financial numbers referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. Use caution and always consult your accountant, lawyer or professional advisor before acting on this or any information related to a lifestyle change or your business or finances. You alone are responsible and accountable for your decisions, actions and results in life, and by your registration here you agree not to attempt to hold us liable for your decisions, actions or results, at any time, under any circumstance.